Monday - Friday 9am - 5pm PST

Text FUNDING +1 346-572-9614

Monday - Friday 9am - 5pm PST

Text FUNDING +1 314-971-9488

More Than Just Your Funding Partners

We are here to be your full funding team behind whichever service you choose

Champion Capital's Financial Solutions:

0% Business Credit Funding

Grow & Scale your Existing Business without utilizing hard earned cash

Start a new venture and grow it more quickly while using the banks money at little to no interest

Not have to raise money or give up equity in your business just to continue growing

Business Credit doesn’t report to personal credit. This keeps your personal credit always stays in a prime funding condition.

Better management of Cashflow since minimum payments are typically only 1% of the total utilized balance.

Build your business credit without needing to buy or use Net 30 Vendor Accounts.

Aged Corporation

Creating an Image of being established in the marketplace

Most businesses fail before their second year

Aged corps can help show the banks you’ve survived that period of time

Get higher approval amounts of business credit because the age of the LLC shows less risk to the banks.

Top Factors banks look for aside from personal credit standing is how established the business is.

New Business Fast Track Funding

No Need to create an LLC from scratch

Start your business credit journey off years ahead

Obtain higher approval amounts and access a longer list of business credit products that you wouldn’t be able to obtain with a brand new LLC

Champion Capital's Financial Solutions:

0% Business Credit Funding

Grow & Scale your Existing Business without utilizing hard earned cash

Start a new venture and grow it more quickly while using the banks money at little to no interest

Not have to raise money or give up equity in your business just to continue growing

Business Credit doesn’t report to personal credit. This keeps your personal credit always stays in a prime funding condition.

Better management of Cashflow since minimum payments are typically only 1% of the total utilized balance.

Build your business credit without needing to buy or use Net 30 Vendor Accounts.

Aged Corporation

Creating an Image of being established in the marketplace

Most businesses fail before their second year

Aged corps can help show the banks you’ve survived that period of time

Get higher approval amounts of business credit because the age of the LLC shows less risk to the banks.

Top Factors banks look for aside from personal credit standing is how established the business is.

New Business Fast Track Funding

No Need to create an LLC from scratch

Start your business credit journey off years ahead

Obtain higher approval amounts and access a longer list of business credit products that you wouldn’t be able to obtain with a brand new LLC

Looking for revenue-based lending or other types of business funding?

Fast Approvals and Funding in as few as 3 days

Working Capital Loan

This loan offers customizable terms based on business needs with no compounding interest for industries like construction, manufacturing, transportation, e-commerce, and medical. Businesses can apply if they have been in operation for at least three months, no minimum FICO score requirement, and $60,000 in annual gross sales.

Accounts Receivable Financing

This financing solution provides a low-cost option with longer terms for the construction, manufacturing, trucking, and medical industries. Qualifications include a 600+ FICO score and $500,000 in annual gross sales. Paperwork includes a funding application and invoices to be leveraged.

Lines of Credit

This funding is available for various sectors including construction, manufacturing, wholesale distribution, e-commerce, and medical. Only pay interest on the funds drawn, credit is available as needed, and fast approvals. To qualify, you must be in business for six months and $60,000 in annual gross sales. No minimum FICO.

Fix N Flip Financing

Targeted toward construction and real estate industries. This loan offers unique benefits, such as rates starting at 8.99%, and it provides 80-100% funding for property purchases and 100% for rehab. The paperwork needed includes a funding application, purchase agreement, renovation budget, and more. To qualify, you need a minimum 650 FICO score.

SBA Loans

An SBA Loan offers terms of up to 25 years with prime rates. These government-backed funds allow for fixed and variable options. Qualifications include 3 years in business, no losses on previous two-year tax returns, and a minimum of $60,000 in annual gross revenue.

Equipment Financing

For businesses that have heavy machinery or equipment needs, this loan offers monthly payments, longer terms, low or no down payment, and tax benefits under Section 179. Qualifications include a 580+ FICO score and no minimum annual gross sales.

We leverage and offer you additional solutions depending on your needs, such as asset-based lending, personal credit stacking, equipment financing, and more, regardless of credit.

Looking for revenue-based lending or other types of business funding?

Fast Approvals and Funding in as few as 3 days

Working Capital Loan

This loan offers customizable terms based on business needs with no compounding interest for industries like construction, manufacturing, transportation, e-commerce, and medical. Businesses can apply if they have been in operation for at least three months, no minimum FICO score requirement, and $60,000 in annual gross sales.

Accounts Receivable Financing

This financing solution provides a low-cost option with longer terms for the construction, manufacturing, trucking, and medical industries. Qualifications include a 600+ FICO score and $500,000 in annual gross sales. Paperwork includes a funding application and invoices to be leveraged.

Lines of Credit

This funding is available for various sectors including construction, manufacturing, wholesale distribution, e-commerce, and medical. Only pay interest on the funds drawn, credit is available as needed, and fast approvals. To qualify, you must be in business for six months and $60,000 in annual gross sales. No minimum FICO.

Fix N Flip Financing

Targeted toward construction and real estate industries. This loan offers unique benefits, such as rates starting at 8.99%, and it provides 80-100% funding for property purchases and 100% for rehab. The paperwork needed includes a funding application, purchase agreement, renovation budget, and more. To qualify, you need a minimum 650 FICO score.

SBA Loans

An SBA Loan offers terms of up to 25 years with prime rates. These government-backed funds allow for fixed and variable options. Qualifications include 3 years in business, no losses on previous two-year tax returns, and a minimum of $60,000 in annual gross revenue.

Equipment Financing

For businesses that have heavy machinery or equipment needs, this loan offers monthly payments, longer terms, low or no down payment, and tax benefits under Section 179. Qualifications include a 580+ FICO score and no minimum annual gross sales.

We leverage and offer you additional solutions depending on your needs, such as asset-based lending, personal credit stacking, equipment financing, and more, regardless of credit.

How Do We Do It?

01.

Strategic Partnerships with Creditors

We maintain strategic relationships with a wide network of creditors and banks to ensure our clients receive the best terms and conditions on their loans.

02.

The Proven Champion Capital Credit Stacking Method

Our proprietary method strategically layers multiple credit facilities to maximize the funding available to our clients, while minimizing cost and complexity.

03.

Team of Experts

Our team brings years of experience and insider knowledge to help our clients put themselves in the best possible situation to successfully secure their loans.

Game Plan

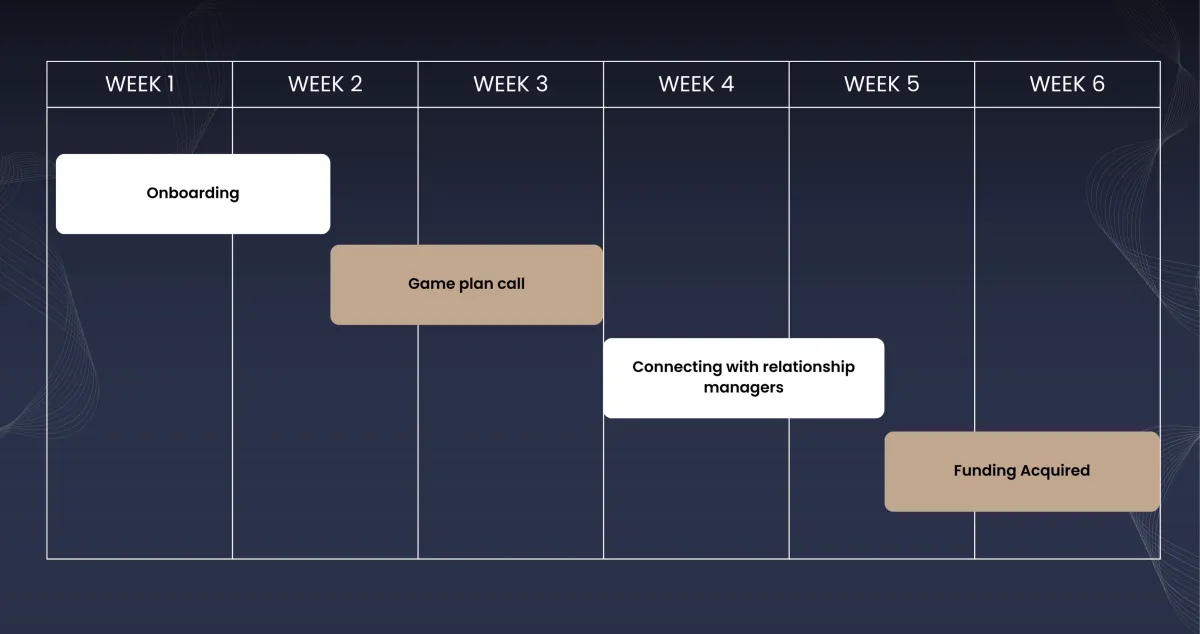

Step #1 Onboarding:

We make is easy and simple to get funding. First we will have you fill out our onboarding details and sign our agreement contract.

Step #2 Game Plan:

Then we will schedule a game plan call which is our onboarding call to go over all the strategy we will be implementing to get you the most funding.

Step #3 Connecting with Relationships Manager:

Then we will connect you with one of special relationship manager. This is what sets us apart from the rest, we have close relationships with trusted banks and have direct access to them to get the most funding possible.

Step #4 Funding Acquired:

Within a couple weeks we will know if you have been approved for funding and how much you have been approved for.

Funding Process

Overcoming Your Starting Point

No matter where you currently stand, whether your credit is less-than-stellar or you lack a lengthy business history, we believe in leveling the playing field.

Our 0% business credit funding provides a unique opportunity for you to secure the necessary funds without the burdensome interest rates and strict requirements imposed by traditional lenders.

Trusted by the Strongest banks

With the support of top-tier banks, we drive our mission to redefine funding for small businesses with confidence and credibility.

Trusted by the Strongest banks

With the support of top-tier banks, we drive our mission to redefine funding for small businesses with confidence and credibility.

© 2024 Champion Capital. All Rights Reserved.